Chapter 13 Bankruptcy Exemptions Chapter 13 bankruptcy does not involve liquidation and generally enables you to keep all of your assets even those that are technically nonexempt. Up to 25 cash back Because the bankruptcy exemption would protect all vehicle equity the bankruptcy trustee would not sell the car.

Overview Of The 7 Most Commonly Used Bankruptcy Exemptions

Employee contributions to Employee Retirement Income Security Act ERISA qualified retirement plans deferred compensation plans tax deferred annuities and health insurance plans are all exempt.

. Any post-bankruptcy earnings are completely exempt in a Chapter 7 filing. Depending on the state you live in you may be able to exclude burial plots church pews wedding rings or firearms from your bankruptcy estate to name just a few items. This is because unlike other states New Jersey has very minimal exemptions to offer its citizens.

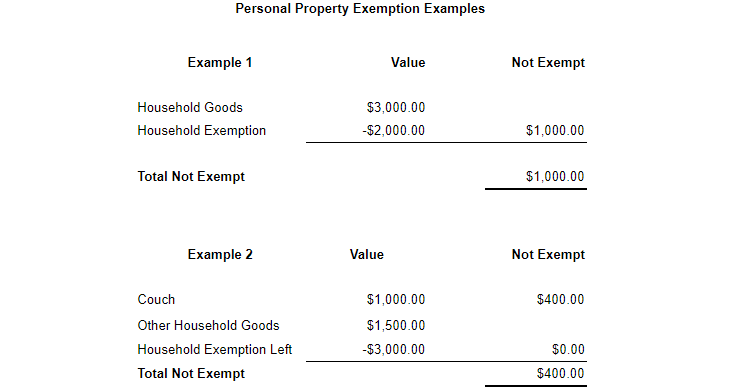

The value of the exempt property may not be over a certain amount. By todays living standards these exemptions are virtually non-existent. Non-Exempt Property in Bankruptcy.

Chapter 7 Bankruptcy Exemptions. Debtor may optionally use the federal bankruptcy exemptions if that state is any of the following which have not opted out of the federal exemptions. In New Mexico a debtor can protect a certain amount of equity that they have in property that is used as a primary residence ie their home.

All of the above are exempt under the federal exemptions. The homestead exemption in bankruptcy protects your home equity from creditors in a Chapter 7 bankruptcy and helps reduce your payments in a Chapter 13 bankruptcy. The Homestead Exemption in Bankruptcy.

Some states and the federal bankruptcy exemptions allow all or a portion of an unused homestead exemption to be used as a wildcard exemption. And can also protect personal property such as household furnishings clothing and jewelry. Cash in the bank of 3000.

ERISA is the Employee Retirement Income Security Act of 1974. Chapter 7 bankruptcy protections can protect a certain amount of value in a car or motorcycle. A homestead of any value.

The Motor Vehicle Exemption in Bankruptcy. Specific Bankruptcy Exemption Examples Some states have a vehicle exemption but the dollar amounts vary wildly. 10000 per month in payments from a pension plan.

Chapter 7 bankruptcy exemptions can help protect some of the types of property the filing party may have concerns about. Alaska Arkansas Connecticut District of Columbia Hawaii Kentucky Massachusetts Michigan Minnesota New Hampshire New Jersey. Pay you the 2000 exemption amount.

Up to 23675 in home equity Up to 3775 for your vehicle. See Nolos website for a complete list. Bankruptcy exemptions may include which of the following Ahomestead home equity up to 21625 BJewelry up to 10000 CTools of trade up to.

Valuing Your Property How to Value Personal Property in Bankruptcy. What Kind of Property Do Bankruptcy Exemptions Protect. If however your state only allows a 2000 car exemption then the trustee could sell your car and do the following with the proceeds.

Two of the above b and c. 11 USC 522d1 Motor Vehicle Exemption. The Motor Vehicle Exemption in Chapter 7 Bankruptcy If you file for Chapter 7 bankruptcy you will most likely be able to exempt protect some equity in your car van truck motorcycle or other motor vehicle.

Motor vehicles Personal property like household goods furniture and musical instruments Health aids Tools of the trade Real estate thats your primary residence Retirement accounts including IRAs. 55800 for spouses who co-own property. Federal bankruptcy exemption amounts apply to cases filed between April 1 2022 and March 31 2025.

11 USC 522d2. Pay the lender 5000. If you can exempt enough equity youll be able to keep your car.

Social Security unemployment benefits 401 disability benefits veteran benefits etc are all protected by federal law. At the federal level certain types of retirement accounts are covered under bankruptcy exemptions. Tenancy by the entirety protection allowed in some jurisdictions.

The federal government provides the following exemptions. Welfare benefits and retirement accounts are almost always protected but only if you list them on your paperwork. Chapter 13 Bankruptcy Exemptions.

Federal law and state laws protect a lot of the same kinds of property including. The Wildcard Exemption in Bankruptcy. New Jersey state bankruptcy exemptions include Household goods and clothing up to a total of 1000 a portion of a persons wages and retirement savings and pensions.

Under the exemptions found in the federal Bankruptcy Code which of the following items may the debtor keep. A person may be able to protect up to a 60000 in value of a dwelling being used. When you file for bankruptcy you will need to include a statement of your exempt property.

Texas bankruptcy exemption law allows for additional pension and retirement account exemptions that the federal law does not. Alaska Arkansas Connecticut the District of Columbia Hawaii Kentucky Massachusetts Michigan Minnesota New Hampshire New Jersey New Mexico New York Oregon Pennsylvania Rhode Island Texas Vermont Washington and Wisconsin. Currently the federal bankruptcy exemptions only apply if you live in one of the following states.

Up to 25 cash back Specific Types of Exemptions. As of 2021 some current bankruptcy exemptions in the state of New Mexico include the following. The Homestead Exemption in Bankruptcy.

A debtor may exempt an aggregate interest not to exceed 13400 less any amount of property of the estate transferred in the manner specified in section 542 d of this title in any accrued dividends or interest under or loan value of any unmatured life insurance contract owned by the debtor under which the insured is the debtor or any. Employee retirement and pension benefits for county and district employees ERISA-qualified government or church benefits Keoghs IRAs and Roth IRAs. Specific Types of Exemptions.

A certain amount of equity in a home. The reason exempt and nonexempt assets are important to Chapter 13 is that the value of your exempt assets is directly commensurate with your Chapter 13 payments. Retirement Benefits If your retirement account is an ERISA-qualified account its generally exempt under both federal and state law.

Those include the following types of accounts.

Bankruptcy Exemptions What Assets Are Exempt In Chapter 7 13

Making Sense Of Alberta Bankruptcy Exemptions Hudson Company Insolvency Trustees Inc

Ontario Bankruptcy Exemptions What You Keep 2021 Hoyes Michalos

Ontario Bankruptcy Exemptions What You Keep 2021 Hoyes Michalos

0 Comments